Okey dokey folks, I have a feeling this might be a long one, so it gets its own post instead lumping it in with my October goals wrap up (coming soon!).

So.

Budget.

Ugh, amirite?!

Whenever I hear the word diet my brain immediately goes to “Diet is a 4-letter word”. Not that I’m against 4-letter words, per se, I just think diets are kinda dumb and don’t work. But we’re not talking about diets now, are we? No we’re not. (That was rhetorical and didn’t really need an answer, but I answer it anyway.).

The reason for my rambling about diet well, I wish there was a phrase that related to budgets. I don’t think “budget is a 6-letter word” quiet sounds the same, does it? No it doesn’t. (Rhetorical again, I know).

So, how did I do?

First, let me start with September. I thought I was doing pretty okay in September until I tallied everything up in WaveApps and realized I had spent four times my food budget. Seriously FOUR FREAKING TIMES. Who does that?! More importantly, HOW?!

*sigh*

Bye bye fun foods.

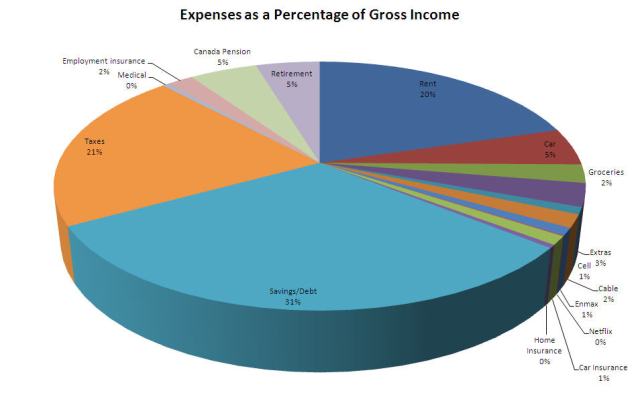

Before getting into the nitty gritty, I have a pie chart for you. I mean, really who doesn’t love pie charts?! Fuddy duddies, that’s who.

This is my pay off debt in six months perfect budget pie chart and how I would like (in a perfect world) everything to fall into place. I do realize this is somewhat unrealistic, but I want to compare my perfect budget against how I actually ended up spending, so here’s how it all shakes out as a percentage of my gross income.

Why my gross income you ask? Because my deductions can change throughout the year (just this month I paid the maximum in my employment insurance and pension amounts, so that means my net income increase. Woo-to-the-freaking-hoo!) so this is a more comparable figure for me.

Enough writing – show us the chart you say?

Ask and you shall receive!

And, just for funsies, I’m also including a comparion with my net income.

That savings section looks pretty effing awesome there, doesn’t it?!

For comparability sake, here is the pie chart of October – my actual spending as a percentage of gross income.

Hmmmm.

I did okay, but looking at that savings/debt section there is a lot of room for improvement.

Since I’m just starting my budgeting/paying off debt journey, I don’t plan on getting too hung up on slip ups. A lot of this included buying some fun running gear (and necessary winter running gear) as well as purchasing some wine while at my marathon in Kelowna. Some quick math tells me that without those purchases, my savings/debt number would have risen from 18% to 26%.

One of my October goals was to keep my spending budgets in the “green/yellow” range in WaveApps. I didn’t quite make it 100%, but I was definitely far better than in food overspending in September!

Slowly, but surely, right friends?!

I have a Google doc spreadsheet that I update with my actual debt balances and my expected spending/income between now and the end of April 2014 and according to that, I’m still on track to have my debt fully paid off by April 30, 2014. I’m doing to do my best to keep to that goal and continue to be mindful of my spending and comparing wants versus needs.

Some days I’m tempted to get discouraged, but just because it seems slow at first, I’m reminding myself that this is a journey and I’m blessed to be able to have a relatively realistic goal of six months to get out of debt. To be super cheesy and link paying off debt to running and training, I know six months ago I would not have physically been able to run a marathon, yet just a few weeks ago I did so, successfully. It takes hard work and mental focus to both run and stick to a budget (because, let’s face it, as much as a marathon hurts, running is fun. Budgeting is decidedly not fun. At all).

In short, hard work pays off.

When I started with controlling my spending (and I’m not brilliant at it now!) I worked out the budget and withdrew the cash for food, shopping, socialising. It has made me focus on what and how I was spending money. Being £10 (or $17 in Canada!) over your food budget for the week doesn’t seem like much when I’m paying with a bank card but it does when I see it in hard cash coming from my purse!

I’ve heard so many people rave about the cash thing. I’ve been resisting (because I’m stubborn!) but I think doing it for a few months could be VERY helpful! No $$ = no food 😦

Pingback: October Goals Wrap Up | Cowgirl Runs